When you are looking to buy an RV, one of the most important factors you will consider is your credit score. This number dictates how much interest you will pay on your loan, and can make a big difference in whether or not you are approved. But what happens if you don’t know which FICO score lenders use when they assess RV loans? Don’t worry – we’ve got you covered! In this article, we will answer all of your questions.

Table of Contents

What Is a FICO Score?

Generated from the credit report data, it serves as a reliable source of information. Keep an eye on your FICO Score since it can affect everything from whether or not you’ll be approved for a loan to the interest rate you will be offered.

What FICO score do RV lenders use?

RV lenders generally use your middle FICO score when evaluating the loan application. It is calculated by taking the average of the three scores from the credit bureaus – Experian, Equifax and TransUnion.

A good FICO score ranges from 670-739. A great score would be 740 or above. If your score is below 670, it can be difficult to get a loan approved and you may have to pay a higher interest rate or provide additional collateral. [1]

What does it take to calculate a FICO credit score?

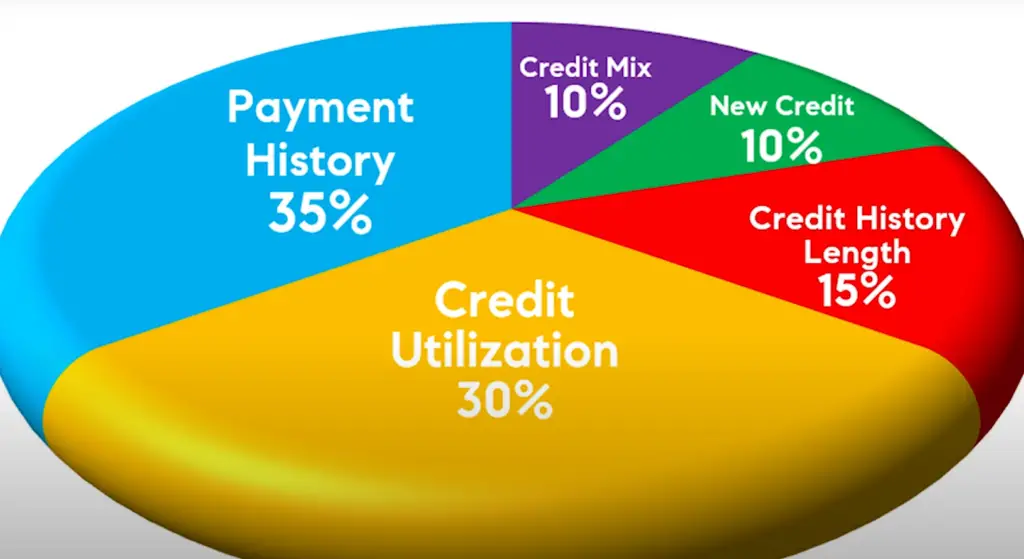

It looks at five key areas.

Payment history

35%. Late payments can remain on your record for up to seven years and can significantly lower your score. Bankruptcies stay on the credit report for 10 years, but if you’ve been consistently making payments since then, it won’t impact your FICO score as much.

Outstanding debt

30%. Your “credit utilization” is determined by the ratio of debt you owe to available credit. Ideally, you should aim to keep the ratio below 30%. This means that if you have access to $10,000 in available credit, you should try not to owe more than $3,000 at any given time.

Length of Credit History

15%. The longer you’ve had credit, the more favorable it looks to potential lenders.

New Credit

15%. New credit refers to the number of new accounts you’ve opened in the past 12 months. Opening too many accounts can lower your score, so try to limit yourself to one or two per year if possible.

Types of Credit Used

10%. This category looks at the different types of loans or lines of credit in your name. The more diverse your types of credit are, the better it looks to potential lenders.

So which FICO score is used for RV loans? It depends on the lender, but most will look at your middle FICO score (also known as “FICO 8”). This version estimates the five categories listed above and gives you a single number that reflects your overall creditworthiness. Most lenders will use this version when evaluating your application for an RV loan.

If you’re applying for an RV loan, now is the time to check your FICO score and ensure it’s in good shape. Paying down any outstanding debt can all help improve your score.

How to maintain a strong FICO Credit Score

Having a strong FICO score is essential when applying for an RV loan. Fortunately, there are several things you can do to ensure your credit score remains in top shape.

First and foremost, ensure that all of your credit accounts are kept up-to-date. This includes paying any bills on time and staying under your credit limits. Additionally, you’ll want to be sure to review your credit report regularly for any errors or suspicious activity that could be negatively impacting your score. If there is anything out of the ordinary, you should contact the appropriate organization right away.

You may also consider using a reputable service like Credit Sesame or Experian Boost to help track and monitor your credit score. These services provide helpful tips on how to further improve your credit health, such as utilizing balance transfer cards and maintaining a low debt-to-income ratio.

Try not to open too many accounts or close old ones in quick succession. Instead, focus on making regular payments and staying within the limits of any existing lines of credit for the best results. With the right strategies in place, you can be sure your FICO score remains healthy enough to obtain an RV loan.

How should you finance an RV even with a low FICO score?

If you’re looking to purchase an RV but have a lower FICO score than necessary, you may still be able to finance it. Lenders understand that people with less than perfect credit may also need to buy big-ticket items like an RV. To accommodate these buyers and increase the likelihood of loan repayment, lenders will sometimes offer special financing deals for those with poor credit.

One option is to approach a subprime lender who specializes in loans for bad credit borrowers. These lenders are often more flexible when it comes to the type of loan they offer and the requirements they set for eligibility. They may require collateral such as a vehicle or real estate in addition to your low FICO score, but they can be more likely to approve a loan than a traditional lender.

You can also look into financing through an RV dealership that may offer special financing programs for buyers with bad credit. These dealerships typically require a higher down payment and may charge higher interest rates, but they can still be helpful in getting you the RV you need even if your credit score isn’t where it should be.

Finally, you could also consider leasing instead of buying an RV. Leasing is usually easier to accomplish with less-than-perfect credit since it doesn’t involve borrowing as much money and there are often more flexible terms available. Plus, since leased RVs are generally cheaper than purchased ones, you might find yourself paying less in the long run anyway. [2]

Tips for Improving the FICO Score Before Applying for a Loan

First, make sure all of your payments are up-to-date and that you don’t have any overdue accounts. Next, limit the amount of new credit accounts that you open.

Another way to improve your score is to focus on reducing the amount of outstanding debt you have. Make sure you’re making payments on time and paying off any loans or bills in full as soon as possible. This will show lenders that you’re serious about sticking to a budget and can help increase the score.

Finally, check for and correct any errors on your report. Even small inaccuracies can affect your ability to get approved for an RV loan so be sure to double-check everything thoroughly before applying.

These tips may seem simple but they can go a long way towards increasing your chances. Taking the time now to build up your credit score will help ensure that you can enjoy your RV for years to come.

FAQ

Can you finance an older RV?

Yes, you can finance an older RV. The age of the RV itself is not a determining factor in whether or not you will be approved for financing. However, other factors such as its condition and value may affect whether you are approved. It’s important to note that most lenders prefer newer RVs since they tend to have higher resale values. [3]

Is it important to get pre-approved for financing before you start buying?

Yes, it is very important. This will give you a better understanding of your budget and let the dealer know that you are serious about making a purchase. It will also make the process go more smoothly since they already have all of your information ready to go. Pre-approval can help save time and money in the long run. Additionally, having a good score may also increase your chances of getting approved for financing as well as potentially securing better interest rates and terms from lenders. [4]

How can interest rates vary from lender to lender?

The interest rate will vary from lender to lender and depend on your credit score. As a rule, the higher your score is, the better chance you have of receiving an interest rate that’s lower. Even if you have excellent credit some lenders may still not offer you their best rates depending on the type of RV loan you choose or other factors such as income. It’s important to shop around for a variety of lenders in order to find the best deal possible.

What is the term of most RV loans?

However, it’s important to keep in mind that the length of your loan will determine the amount you pay back each month so choosing the correct loan term for your budget is crucial. Generally speaking, shorter terms mean higher payments but less total interest paid over time while longer terms mean lower payments but more total interest paid over time. [5]

Useful Video: Is Financing an RV for 20 Years a Good Idea?

Conclusion

In the end, it all comes down to understanding which FICO score is used for RV loans. Generally speaking, lenders prefer to use the FICO 8 scoring model when evaluating your application and creditworthiness. However, other scoring models may be taken into consideration depending on the specific lender. To ensure that you are getting the best interest rate possible on your loan, ensure to check your credit report regularly and work towards improving your score in order to maximize your chances of getting a good deal on an RV loan. Additionally, you should research different lenders and compare their rates before making any final decisions. Good luck!

References

- https://www.thebalancemoney.com/best-rv-loans-5088419

- https://justdownsize.com/what-fico-score-do-rv-lenders-use/

- https://www.riversidetrailer.com/finance-an-rv-over-10-years-old/

- https://www.suncorp.com.au/learn-about/buying-a-home/loan-pre-approval.html

- https://www.macu.com/loans/vehicle-loans/rv

Leave a Reply